30+ Home mortgage calculator excel

As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. Biweekly Mortgage Calculator with Extra Payments.

Best 10 Mortgage Calculator Apps Last Updated September 19 2022

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

. The most common terms for a fixed-rate mortgage are 30 years and 15 years. To get the number of monthly payments youre expected to make multiply the number of years by 12 number of months in a. Our calculator includes amoritization tables bi-weekly savings.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Loan term in years - most fixed-rate home loans across the United States are scheduled to amortize over 30 years. Other common domestic loan periods include 10 15 20 years.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. This table also presumes a 1000 annual homeowners insurance policy along with 2500 in annual real estate taxes. Insurance or Fannie Mae loans up to 30 years or FHA loans up to 35 years for refinance.

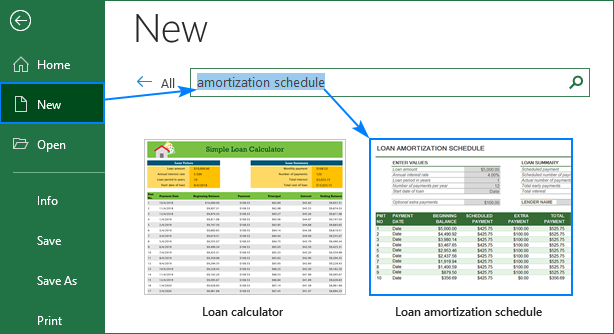

With this offset calculator you can. Free Excel template Mortgage calculator with extra payments and lump sum Excel Template. Check out the webs best free mortgage calculator to save money on your home loan today.

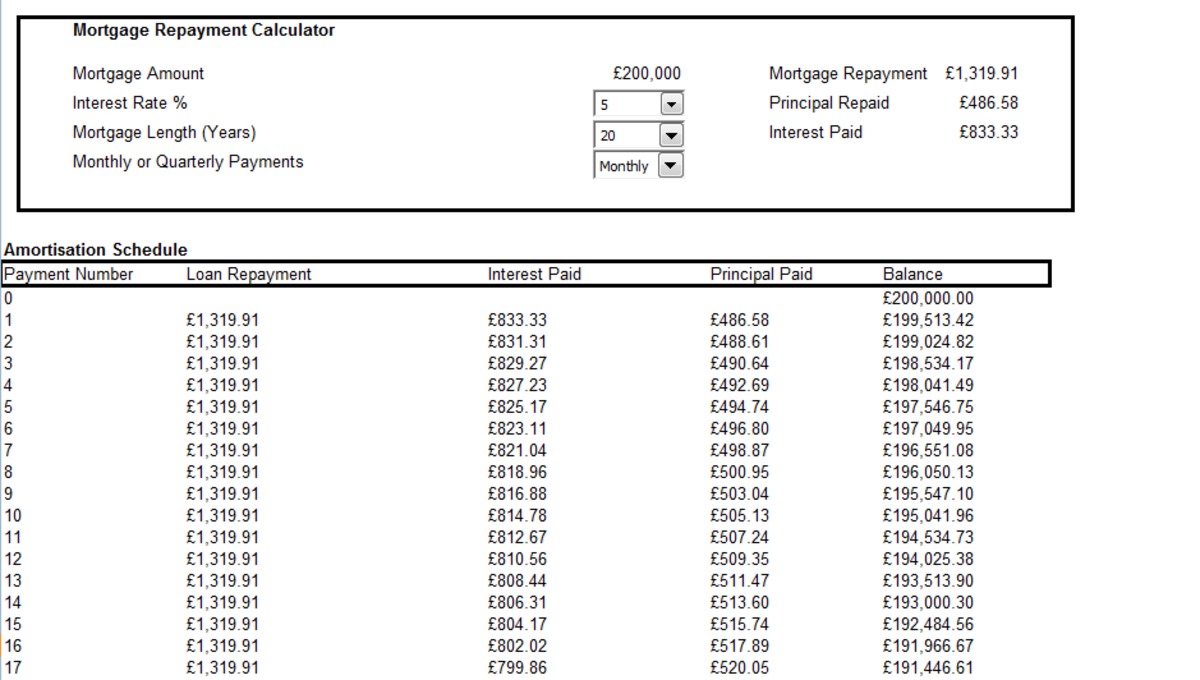

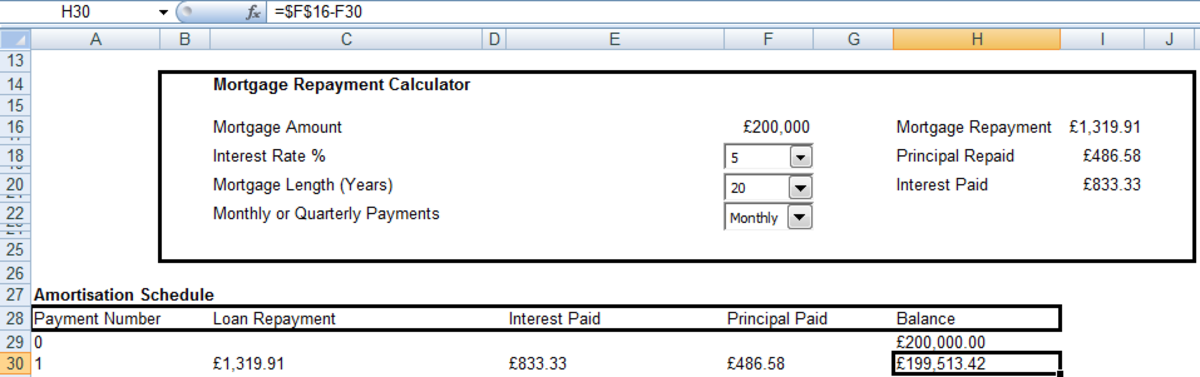

This Mortgage Offset Calculator is far better than those currently available on the market. How to Calculate Mortgage Payments in Excel With Home Loan Amortization Schedule Extra Payments. Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions.

Welcome to our commercial mortgage calculator. 1 choose home loan repayment frequency by weekly fortnightly or monthly. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals.

The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much. 2 vary mortgage terms from 1 to 30 years. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D.

See the monthly payments total interest and amortization for a 350000 mortgage over 15 or 30 years and use our calculator to see your own payments. Lets calculate the monthly payment on a 500000 30-year fixed mortgage with a 5 interest rate. On a traditional loan you typically have a structured 30-year repayment and the amortization schedule will show a balance that.

Everyday Hero Housing Assistance Fund EHHAF is a fund of Virtual Sports Academy and a home buying assistance program dedicated to firefighters police teachers medical workers and many other community heroesOur unique approach to the home buying process allows you to receive gift funds to help cover part of the closing costs on your home purchase. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. With the saved dollars increase the monthly payment of your home mortgage loan.

Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Explore personal finance topics including credit cards investments identity. For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR.

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. Both numbers are close to the national average though local conditions can vary widely based upon environmental risks like. Here you can calculate your monthly payment total payment amount and view your amortization schedule.

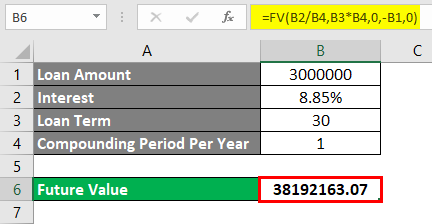

The Vertex42 Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side. If using excel you can calculate the monthly payment with the following formula. FREE Reverse Mortgage Amortization Calculator Excel File August 6.

Saving 3420 in interest. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. A P i100.

Annual Interest Rate APR. For the same 200000 30-year 5 interest loan extra monthly payments of 6 will pay off the loan four. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the mortgage in full.

For mortgage loan it is normally 15-30 years. It calculates your monthly payment and lets you include additional extra payment prepayments to see how soon you could pay off your home or how much you could save by paying less interest.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Creating An Amortization Loan Or Mortgage Schedule Using Excel 2007 And Excel 2010 Hubpages

Loan Emi Calculator In Excel Xls File Download Here

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

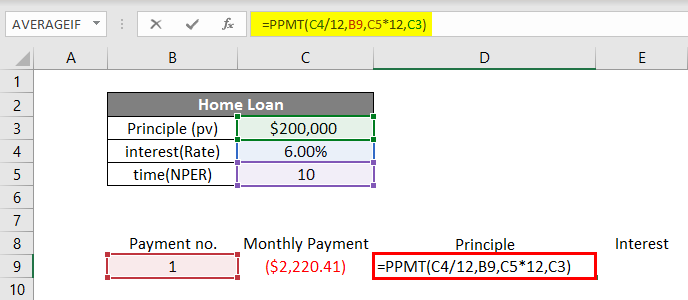

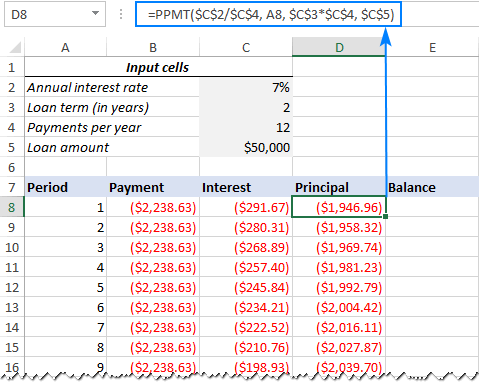

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Calculate Compound Interest In Excel How To Calculate

Excel Homework 3 3 Tv Loan Video Youtube

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Creating An Amortization Loan Or Mortgage Schedule Using Excel 2007 And Excel 2010 Hubpages

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Calculate Compound Interest In Excel How To Calculate

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Mortgage Calculator How To Calculate Loan Payments In Excel